Hassle-Free Small Business Financing

Business Finance Source small business financing from $5,000 – $850,000. Apply today without impacting your credit score. 100% online, with an initial decision in 60 seconds.

Your Business Needs Hassle-Free Financing Options. We’ve Got 4 Different Small Business Loans Available for You.

Merchant Cash Advance Financing

For small businesses with many customer credit card transactions. Learn More

Loan Amount

$5,000 to $850,000

Speed of Funds

24 hours

Factor Rate

1.15 upwards

Repayment

3-18 Months

Secure a lump sum of funds for your business in exchange for a percentage of your future daily credit card sales. Merchant cash advances are easy to qualify for as approval is based on the volume of your monthly credit card sales, not your credit history or collateral. Merchant cash advances also offer a fast way to access funds for your business. There’s no need to go through a lengthy or complicated loan application process. Simply fill out a form and share the average monthly credit card sales processed by your business, and you’ll receive a decision in 60 seconds and the funds can be deposited in your business bank account in as little as 24 hours.

Business Lines of Credit

For small businesses that experience fluctuations in cash flow or have seasonality. Learn More

Loan Amount

$5,000 to $300,000

Speed of Funds

24 hours

Interest Rate

5% upwards

Repayment

6-18 Months

A business line of credit from Business Finance Source provides a predetermined amount of cash on demand, so you can access a revolving source of funds before you need them. With a line of credit, you can access these funds anytime, ensuring that your business runs smoothly every day. You only pay interest on the actual amount used, not the full credit limit. Applying for a business line of credit is much faster than a traditional loan and you can have your credit line setup in as little as 24 hours.

Business Equipment Financing

For small businesses looking to buy equipment without tapping into their cash reserves. Learn More

Loan Amount

$5,000 to $850,000

Speed of Funds

2-4 weeks

Factor Rate

Starting at 8.95%

Repayment

1-8 years

Owning the right business equipment is vital to maximizing your business’s potential. Boosting efficiency and productivity means investing in business equipment. At Business Finance Source, we offer business equipment loans to give you access to the funds you need to acquire the equipment your business needs, without dipping into your cash reserves or working capital. Our business equipment loans are easier to obtain than traditional loans since no collateral is required. The purchased equipment serves as collateral for the loan.

Unsecured Business Financing

For Businesses need to borrow large sums of money. Learn More

Loan Amount

$10,000 to $850,000

Speed of Funds

24 hours

Interest Rate

Starting at 8.95%

Repayment

1-5 year

At Business Finance Source, we understand that many small businesses lack the collateral they need to secure a traditional business loan. That’s why we offer unsecured business loans that don’t require collateral, making it a great option for business owners who may not have enough assets to secure a loan. Our unsecured business loans offer complete freedom to use the funds in any area of your business, with no restrictions or limitations.

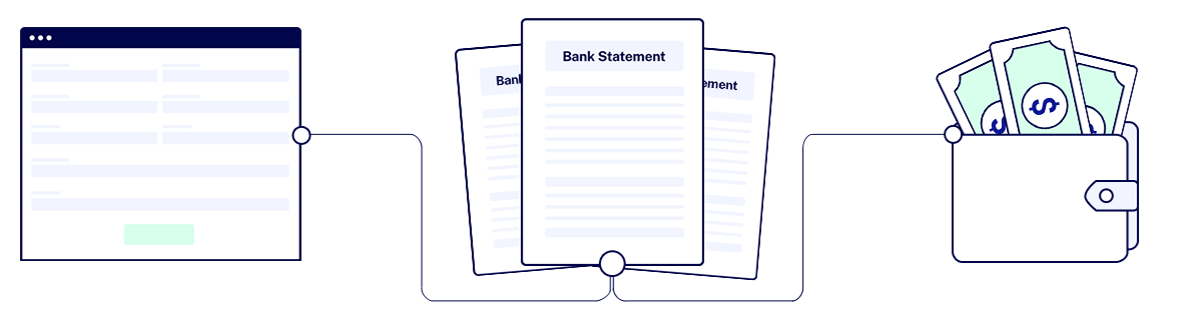

How to Get Financing from Business Finance Source™

1

Apply Online

Our platform evaluates your loan application and gives you an initial decision in 60 seconds.

2

Upload Bank Statements

Once you’re pre-approved, upload the last 3 months of your bank statements to get final approval.

3

Get Funded

After final loan approval, get the funds deposited into your bank account in as little as 24 hours.

What you need to apply

To apply for business Financing at Business Finance Source, all you need are these 4 items.

Be in business for 6 months or more

Provide 3 Months Bank Statements

Have an active Business Bank Account

Business must make +$7,500 per month

Who can apply?

You can apply for finance with Business Finance Source if you’re a US citizen or resident over the age of 18 years of age.

Why Choose Business Finance Source™ for Your Small Business Financing Needs

- We fund your loans directly with our own money, unlike many lending websites that just act as brokers.

- We accept loan applications from business owners with bad credit.

- We do not require collateral to secure a loan.

- The only paperwork we require is three months of business bank account statements.

- We fund your loan based on your business’s cash flow, not your credit score or collateral.”

Calculating Your Interest Rate

Interest rates for small business loans vary based on the amount borrowed, repayment plan, and credit score. Business Finance Source offers rates starting at 8.95%, which increase for high-risk loan applications. The final rate is calculated based on risk evaluation by a loan underwriter. Use our business loan calculators to determine repayment amounts based on your desired interest rate.

How Our Borrowers Put Small Business Financing and Loans to Work

Improve Cash Flow

Many business owners that borrow from Business Finance Source face difficulties with cash flow management. By getting a small business loan, they can cover any cash flow shortfalls and still have enough money to grow their business and pay their day-to-day expenses.

Buy or Upgrade Equipment

A lot of small business owners we talk to lack the funding to buy business equipment that will help their business offer better services, be more efficient, increase productivity, and boost their bottom line. At Business Finance Source, we understand how critical it is for a business to have the right equipment to stay competitive, so we offer a specific loan product called a Business Equipment Loan to help business owners purchase the equipment they need to drive their business forward.

Fund Business Growth

Growing a business is the goal of every business owner, but a lack of capital is one of the main obstacles to growth. Business Finance Source offers small business loans that allow you to invest in your company without having to surrender equity. This way, you can finance your growth and maintain control over your business.

How to Decide Which Small Business Financing is Right for You

Here’s how to choose the right small business loan for you:

- Determine your funding needs, loan usage, and preferred repayment terms.

- Next check out our 4 loan types, each with its own borrowing limits, interest rate ranges, and repayment schedules.

- Finally pick the loan type that best matches your needs.

To make it even easier, here is a breakdown of the benefits of each loan and when it would be suitable for your business:

Merchant Cash Advance Financing is suitable for small businesses with many customer credit card transactions. This loan is easy to qualify for and offers a fast way to access funds for your business. Approval is based on the volume of your monthly credit card sales, not your credit history or collateral.

Business Lines of Credit are suitable for small businesses that experience fluctuations in cash flow or have seasonality. With a line of credit, you can access funds anytime, ensuring that your business runs smoothly every day. You only pay interest on the actual amount used, not the full credit limit.

Business Equipment Loans are suitable for small businesses looking to buy equipment without tapping into their cash reserves. These loans are easier to obtain than traditional loans since no collateral is required. The purchased equipment serves as collateral for the loan.

Unsecured Business Loans are suitable for businesses that need to borrow larger sums of money but do not have enough assets to secure a large loan. It offers complete freedom to use the funds in any area of your business, with no restrictions or limitations.

Consider your specific business needs and choose the small business loan that best suits them. Business Finance Source offers a range of loan options to help you unlock your business potential.

How Business Finance Source Helps Underserved or Underrepresented Entrepreneurs

Minorities

Business Finance Source provides small business loans to help entrepreneurs from historically underserved communities grow their businesses with access to capital. We understand the challenges that minority business owners face, and we are committed to providing resources and support to help them succeed.

Veterans

Business Finance Source supports our veterans as they enter the world of business ownership and give them access to capital to help with business expenses. We understand the unique challenges that veterans face in transitioning from military service to entrepreneurship, and we are committed to providing the resources and support they need to succeed.

Small Business Financing Explained

What is Small Business Financing?

Small business financing is getting money from a source to start, buy, or bring money into an existing business for current or future business activities. There are two categories of financing for small businesses: debt financing and equity financing. You can research and compare all the different types of financing outlined here to figure out which type of small business financing best suits your needs.

Business Debt Financing Explained

What is Debt Financing?

Debt financing is borrowing money from an outside source and repaying it with interest over time. The purpose of debt financing is to secure money for working capital or business growth.

Types of Business Debt Financing

Secured Business Loans

Loans secured by personal or business assets.

Unsecured Business Loans

Loans that are not secured by assets, guarantees, or collateral.

Business equipment Financing

Loans to buy business equipment and then this equipment becomes the loan’s collateral.

Invoice Financing

Borrow money against outstanding customer invoices.

Business Lines of Credit

Withdraw money from a credit limit, paying interest only on what you withdraw.

Merchant Cash Advance Financing

Get a lump sum of money in exchange for a percentage of your business’ future credit card sales.

Business Credit Cards

Business credit cards have high spending limits which can help with gaps in cash flow.

Bank Overdrafts

Get a bank approved line of credit for your business attached to your business bank account.

Capital Loans

Loans used to pay for day-to-day business expenses and that loan is repaid over a long period of time.

Business Leasing

Pay monthly payments to use an asset in your business without having to buy that asset.

Commercial Real Estate Loans

Purchase commercial real estate with a loan secured by a lien on that real estate.

Microloans

Loans for very small businesses that may be struggling to get access to finance.

Peer-to-peer lending

Loans from individuals or groups rather than traditional financial institutions.

Bond Issuance

Issuing bonds in order to raise capital.

IPO (Initial Public Offering)

Selling shares of a company to the public in order to raise capital.

Business Grants

Federal government grants for small businesses that do not need to be repaid.

Credit Union Financing

Loans from credit unions that are typically offered to members of the credit union.

Small Business Loans

Loans from lenders that offer funding specifically for small businesses.

Business Equity Financing Explained

What is Equity Financing?

Equity financing is selling shares in a business to investors to raise capital. The purpose of equity financing is to get access to capital to use in the business that does not have to be repaid.

Types of Business Equity Financing

Angel Investing

Investment made by wealthy individuals in exchange for equity in a company.

Venture Capital Financing

Large investment made by a venture capital firm in exchange for equity in a company.

Mezzanine Financing

A type of debt financing that is a combination of debt and equity.

Crowdfunding

Raising money from a large number of people, usually through the internet.

Private Equity

Equity investment made by private investors or investment firms into a company.

Employee Stock Ownership Plan (ESOP)

A plan in which employees of a company own shares of the company’s stock.

Convertible Debt

A type of loan that can be converted into equity at a later date.

Preferred Stock

A type of stock that has a higher claim on assets and earnings than common stock.

Common Stock

A type of stock that represents ownership in a corporation.

Secondary Offering

The sale of additional shares of a company’s stock after the initial public offering.

Seed Financing

Early stage funding for startup companies to develop a concept or product.

Series A Financing

The first round of venture capital financing for a startup company.

Series B Financing

The second round of venture capital financing for a startup company, usually for expanding the business.

Series C Financing

The third round of venture capital financing for a startup company, usually for preparing for an IPO or acquisition.

Initial Public Offering (IPO)

The process by which a private company can go public by issuing and selling shares to the public.

Direct Public Offering (DPO)

A method of raising capital by selling shares directly to the public, rather than through a securities exchange or underwriter.

Benefits and Drawbacks of Small Business Financing

Benefits

Taking out a small business loan can be good for your company. Here’s why:

- Make your company grow faster: With a loan, you can start expanding your business right away, instead of waiting for it to make enough money on its own.

- Keep control of your business: With a loan, you don’t have to give up any ownership of your business to get the money you need. This means you can keep all the profits and make decisions without anyone else’s input.

- Fix cash flow problems: Sometimes, small businesses can have trouble with money coming in and going out at the right times. A loan can help you handle these issues.

- Use the money however you want: With a loan, you usually have the freedom to use the funds however you want, unlike with investors who might have specific rules.

- It can be affordable: Business loans can be a better deal than using credit cards or personal loans because the interest rates can be lower. And if you choose a secured loan, you may get even lower rates.

Drawbacks

Small business loans can be helpful but they also have downsides. Here are a few things to keep in mind:

- Long application process: To get a loan, you’ll need to fill out an application and provide a lot of paperwork like tax returns and financial statements.

- Risk of losing assets: Some loans require you to put up something valuable like a business asset or even your home as collateral. If you can’t make the payments, you could lose that asset.

- Good credit needed: The interest rate you pay for a loan depends on your credit score. If it’s not good, you may end up paying more.

- Takes time to get the money: Getting a loan can take a long time, especially for certain types like SBA loans.

- Limited repayment options: Most business loans have fixed terms and require regular monthly payments, which may not be ideal if your business’s income fluctuates.

What to Prepare Before Applying

Update Your Business Plan and Financial Records

It’s a good idea to have your accountant or bookkeeper create the latest versions of your income statement, balance sheet, and statement of cash flow. You should also update your business plan to include the loan you intend to apply for and what you intend to use the funds for, plus include the repayments into your cash flow projections.

Gather Your Paperwork

Ask the lender what paperwork they need: Before you apply, find out what financial documents and records the lender will want to see. Gather all the paperwork: Once you have all the necessary paperwork and know you meet the lender’s credit score requirement, you can fill out the loan application.

Check Your Credit Score

Make sure your credit score meets the lender’s requirements. You can check your credit score for free by visiting one of the following websites:

- Credit Karma: offers free credit scores from TransUnion and Equifax, as well as credit monitoring and personalized recommendations to improve your score.

- Experian: one of the three major credit reporting bureaus, Experian offers a free credit score and report, as well as credit monitoring and alerts.

- Annualcreditreport.com: federal law allows you to check your credit report once a year from each of the three credit reporting agencies (TransUnion, Equifax, and Experian)