Funding Amounts

$5,000 to $850,000

Funding Time

24 hours

Factor Rate

1.15 upwards

Repayment Terms

3-18 Months

MCA Funding for Small Businesses Across the USA

We help small business owners across the USA who are looking for a quick way to access funding without the hassle of providing all the requirements and going through the slow process of applying for a loan with a traditional lender like a bank.

We offer Merchant Cash Advance Financing that allow you to get a lump sum of funding for your business in exchange for a percentage of your future daily credit card sales

There’s no need to go through a lengthy or complicated loan application process. Business owners don’t need collateral, and those with poor credit can apply for a Merchant Cash Advance from Business Finance Source™.

Simply fill out the MCA form, provide the average monthly credit card sales processed by your business, and you’ll receive a decision in 60 seconds. Your MCA funds can be deposited in your business bank account in as little as 24 hours.

The Easier Path to Get Lump Sum of Cash Instead of a Loan

Don’t let a cash crunch hold you back. Poor credit accepted. Minimal paperwork. Get the cash infusion your business needs by exchanging a percentage of future credit card sales.

Fast Decision

Get pre-approved for an MCA in 60 seconds and receive final approval and funding in as little as 24 hours.

Minimal Paperwork

Just upload your last 3 months of business bank account statements.

No Collateral Required

Future credit card sales act as collateral for the MCA.

Poor Credit Accepted

We can still offer MCAs even if you have poor credit.

How to Get a Merchant Cash Advance from Business Finance Source™

At Business Finance Source™ we make it simple for small business owners to apply for and qualify for merchant cash advance funding. Here’s what you need to know about the MCA application process and eligibility requirements.

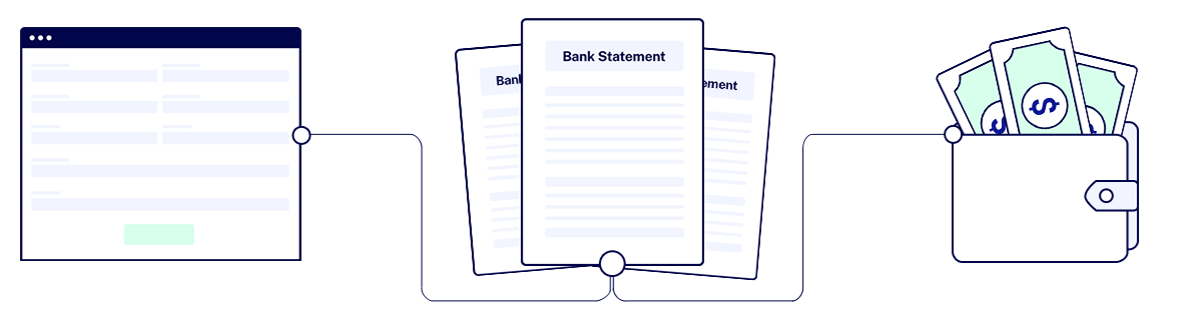

MCA Loan Application Process

1

Apply Online

Our platform evaluates your MCA application and gives you an initial decision in 60 seconds.

2

Upload Bank Statements

Once you’re MCA is pre-approved, upload the last 3 months of your bank statements to get final approval.

3

Get Your MCA

After final approval, get your MCA funds deposited into your bank account in as little as 24 hours.

RESOURCE

If you want to learn more about the general process of getting a merchant cash advance, check out our article on “How to Apply for a Merchant Cash Advance?”

MCA Eligibility Requirements

You only need to meet the four requirements below to qualify for Merchant Cash Advance financing at Business Finance Source™.

Be in business for 6 months or more

Provide 3 Months Bank Statements

Have an active Business Bank Account

Business must make +$7,500 per month

Who can apply?

You can apply for an MCA with Business Finance Source if you’re a US citizen or resident over the age of 18 years of age.

RESOURCE

If you would like to know more about the general process of qualifying for a merchant cash advance, be sure to check out our article “How to Qualify for a Merchant Cash Advance.”

Merchant Cash Advance Financing Explained

What is an MCA?

Merchant cash advance financing involves a lender providing a lump sum of money to a business in exchange for a percentage of future credit card and debit card sales. Compared to traditional financing, merchant cash advances are easier to qualify for. This is because the lender’s decision to fund is based on average monthly credit card sales, not just credit history or collateral.

RESOURCE

With so many business financing options available in the US lending marketplace we recommend reading our article “Is A Merchant Cash Advance Right For Your Business.”

How Does an MCA work?

- MCA Application: The business owners fills out an application form with information about their business and how much money they make selling things with credit cards.

- MCA Underwriting Process: The merchant cash advance provider accesses the business information and decides how large a cash advance they intend to offer and how much they will charge for it.

- MCA Credit Decision: If the business owner accepts the offer, an agreement is made between the business owner and the MCA provider regarding the cash advance amount, the payback amount, and the holdback percentage.

- MCA Funding: Once an agreement is finalized, the cash advance is transferred to the business’s bank account.

- MCA Repayment Process: A percentage of the businesses debit and credit card sales volume is withheld each day to pay back the advance. This withholding process is called a “holdback”. Daily holdbacks continue until the MCA is fully repaid.

RESOURCE

For a full explanation check out our article “How does a merchant cash advance work”

What is an MCA Factor Rate?

Instead of paying interest on a cash advance, you pay a factor rate. This rate is used to calculate how much a business needs to pay back. For example, if you borrow $10,000 and the MCA company offers you a factor rate of 1.1, you will need to pay back $11,000. Different lenders offer different factor rates, but these rate is usually between 1.1 and 1.5.

Lenders must assess the level of risk to lend to a business. The higher the level of risk to lend to the business, the higher the factor rate, and the more money the business will have to repay.

The main things they consider are:

- The risk and profitability of the industry in which the business operates

- The length of time the business has been operating

- The amount of credit card sales processed each month

- The creditworthiness of the business and its credit rating

All of these factors are taken into consideration by the lender when calculating the factor rate it intends to offer the business.

RESOURCE

We’ve created a more detailed article on “Understanding Merchant Cash Advance Factor Rates” to help you navigate the confusing process of calculating the factor rate for an MCA.

Repayment Terms

Repayment Period: MCA companies offer repayment periods ranging from 3 months to 18 months.

Repayment Frequency: Most MCA companies require you to make daily or weekly payments.

Repayment Amount: Most MCA companies require you to pay between 5% and 20% of daily debit and credit card sales. The percentage taken is known as the “holdback rate.

Merchant Cash Advance Financing Calculator

If you would like to compare the borrowing costs of other small business loans available at Business Finance Source, you can use our other business loan calculators.

RESOURCE

If you want to know how merchant cash advance fees and rates are calculated, and see examples of the process, you can check out our article titled ”How Are Merchant Cash Advances Calculated?”

What Can an MCA Be Used For?

Merchant cash advance financing can be used for a variety of business purposes such as:

- Purchasing product inventory

- Working capital

- Covering cash flow gaps

- Financing new initiatives

- Business sales and marketing

- Unexpected business expenses

RESOURCE

If you’re curious about everything you can use a merchant cash advance for, check out our article on “What Can a Merchant Cash Advance Be Used For.”

Benefits and Drawbacks

The main advantage of MCA Financing is that it is easier to qualify for than traditional financing. This is because the lender is more interested in the business’s future sales than in its credit history. The downside of MCA funding is that it can be more expensive than traditional financing.

MCA Advance Benefits

- Faster access to financing than traditional loans, usually within two or three days

- Easier to qualify for than a conventional loan

- MCA advances are possible even with bad credit

- Easy repayment terms based on a percent of daily sales

- No collateral required

- Good short term financing option

MCA Advance Drawbacks

- Some brokers and lenders charge additional origination fees

- MCA financing is more expensive and has higher interest rates than traditional bank loans

- A high volume of daily credit card transactions is required

- The APR can be quite high compared to what you’d get from a traditional bank loan

- If you don’t process credit card sales, you can’t get an MCA

MCA Financing FAQs

Yes. You can qualify for a cash advance if you have a poor credit history or a weak credit profile

MCA’s are different from loans. Business loans are repaid over a fixed period of time and at a fixed rate. Merchant cash advances are repaid daily. The merchant cash advance company takes a small percentage of the business’s credit card sales each day until the money and fees are repaid.

A business cash advance is an alternative term for a merchant cash advance. A business cash advance is like a loan that helps a business buy things it needs. The business pays back the money borrowed with a part of the money it earns from customers paying with credit and debit cards.

Most merchant cash advance providers want a business to be operating for at least 1-2 years and have verifiable credit and debit card transaction history before it will fund. We require you to have been in business for 6 months.

Most lenders require a personal credit score or a business’ credit score of 550 or above. But if your business has strong credit card sales some lenders will fund businesses with less than perfect credit.

Failure to pay back an MCA constitutes a breach of contract and a default on your MCA agreement. Merchant cash advance companies will work with you to structure a repayment plan. In the event that this fails, the merchant cash advance company will attempt to recoup the funds it lent your business by filing legal proceedings.

Most MCA companies offer between $2,500 and $500,000. You can get up to $850,000 from Business Finance Source™.

Learn More about MCAs

Apply For Business Finance Now

Borrow between $5,000 and $850,000. The application process is 100% online, with an initial decision in just 60 seconds and applying won’t your credit score.